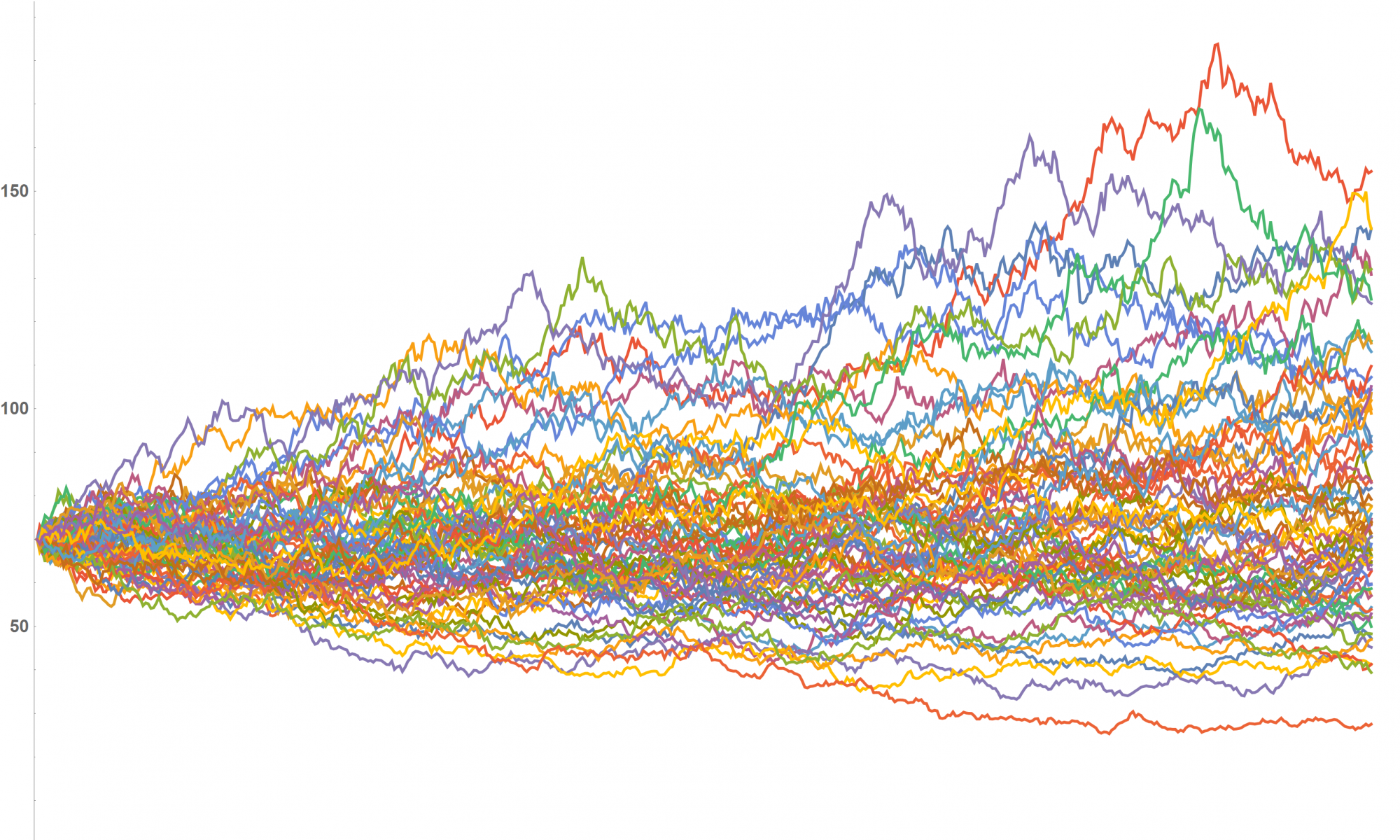

In the MathBox entry from 13 December, we showed the implied distribution of DAX returns when using the Cornish Fisher expansion.

As a rule of thumb, this works nicely as long as the excess kurtosis is smaller than 8. What happens if the implied distribution of returns is really fat-tailed?

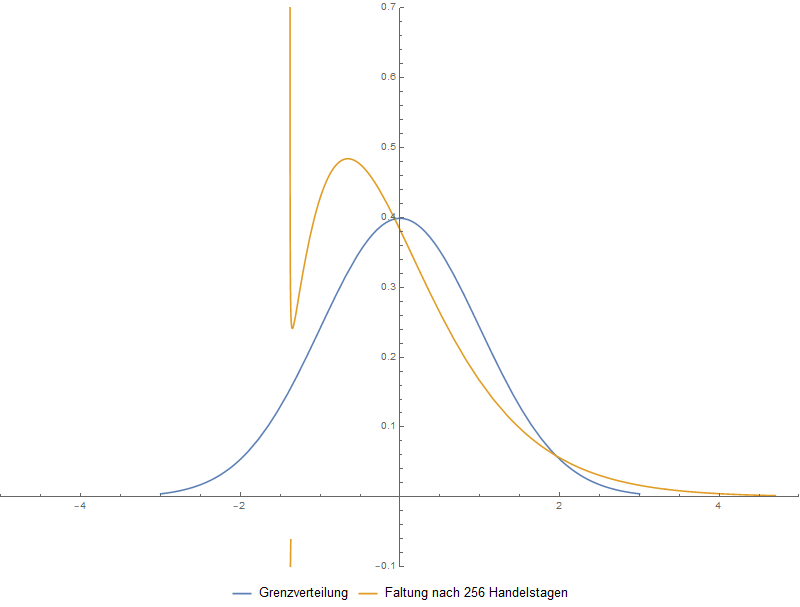

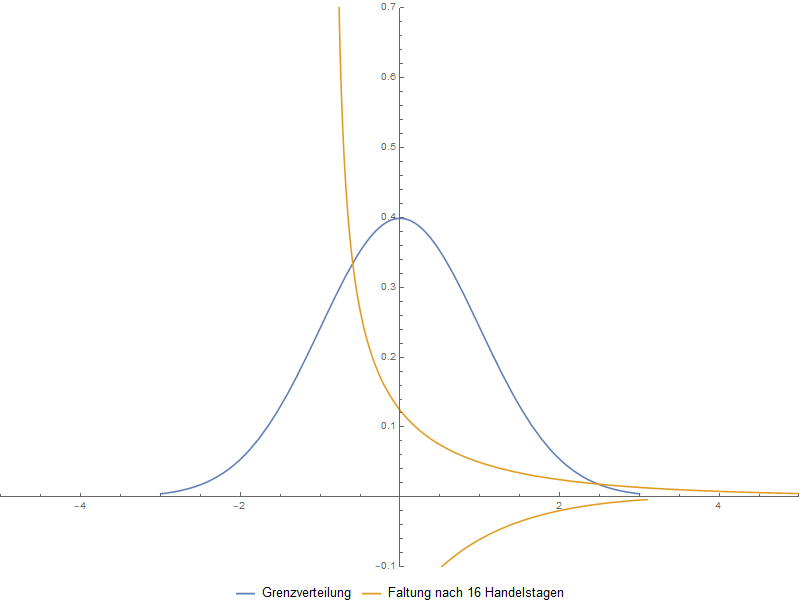

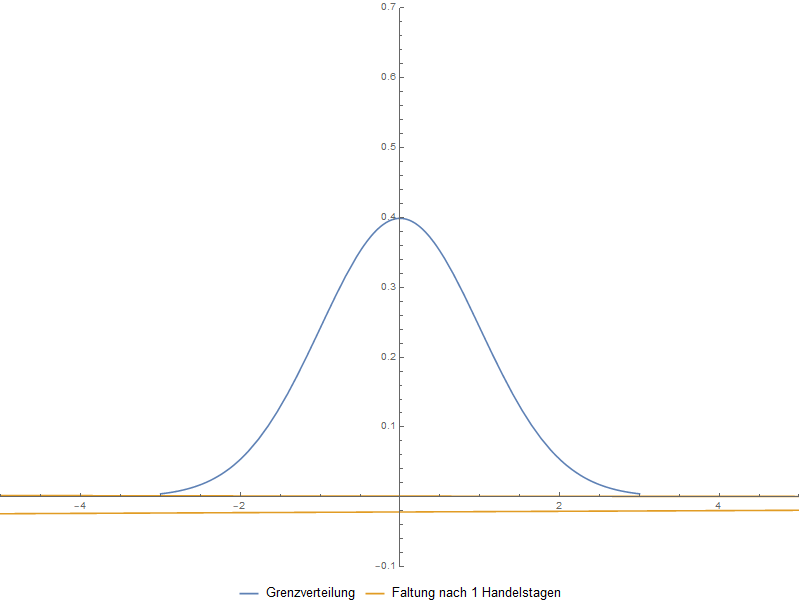

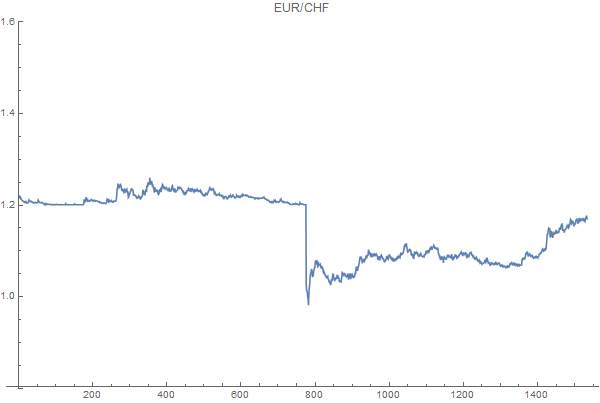

The exchange rate of EUR and Swiss Franc between the years 2013 and 2017 showed an excess kurtosis of 590. The Cornish-Fisher transformation between the implied distribution of returns and the standard normal distribution is not bijective any more and leads to weird distributions.