A Workout in Computational Finance

The Workout Chapters

- Introduction and Reading Guide

- Binomial Trees

- Finite Differences and the Black-Scholes PDE

- Mean Reversion and Trinomial Trees

- Upwinding Techniques for Short Rate Models

- Boundary, Terminal and Interface Conditions and their Influence

- Finite Element Methods

- Solving Systems of Linear Equations

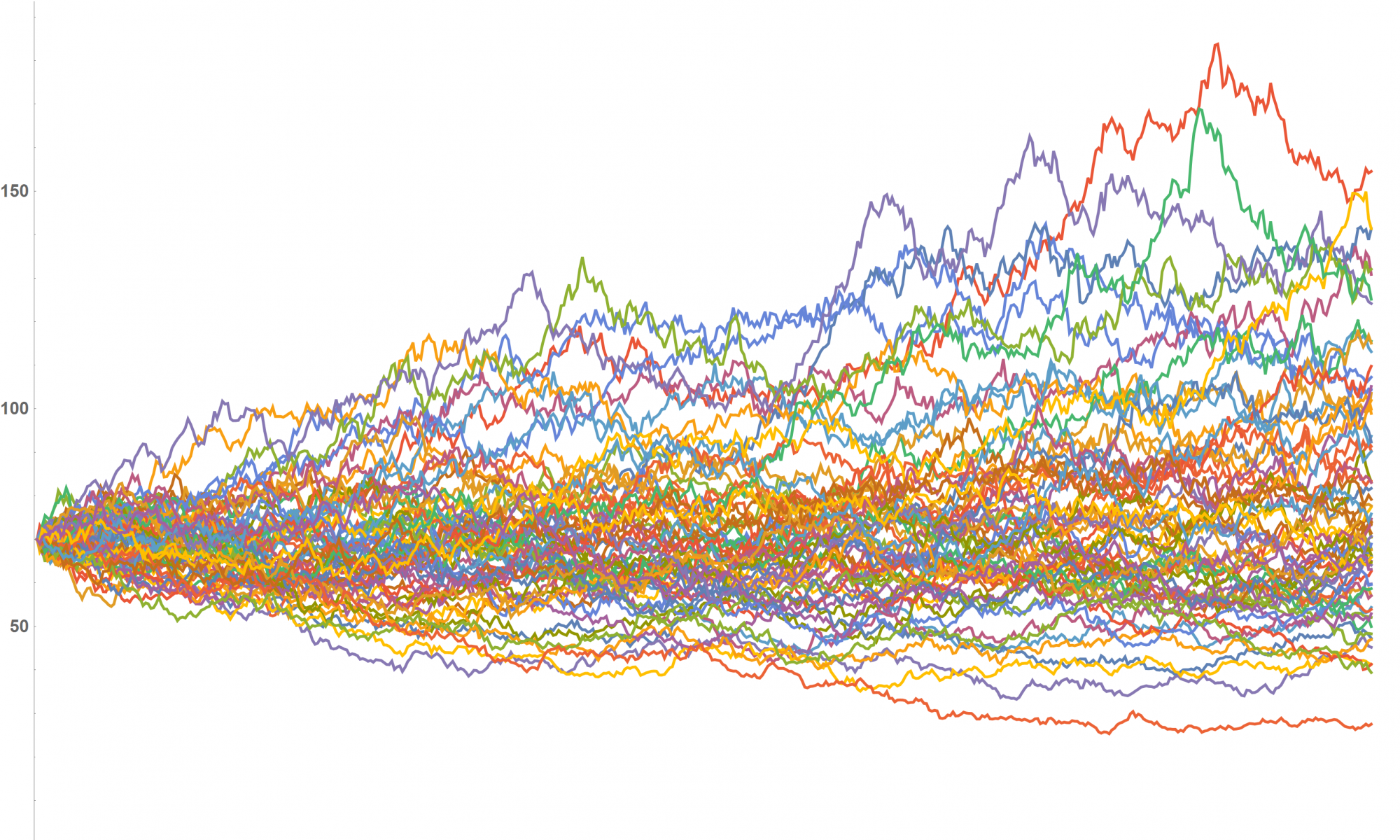

- Monte Carlo Simulation

- Advanced Monte Carlo Techniques

- Valuation of Financial Instruments with Embedded American/Bermudan Options within Monte Carlo Frameworks

- Characteristic Function Methods for Option Pricing

- Numerical Methods for the Solution of PIDEs

- Copulas and the Pitfalls of Correlation

- Parameter Calibration and Inverse Problems

- Optimization Techniques

- Risk Management

- Quantitative Finance on Parallel Architectures

- Building Large Software Systems for the Financial Industry

Reviewers’ Endorsements

“Mathematical Finance needs both: a well-founded theory based on stochastic calculus as well as numerical valuation schemes that work. In A Workout in Computational Finance the authors put emphasis on the numerical aspects and present an impressive range of numerical methods. All these techniques have been implemented by their group and can be used as a starting point for building a professional software system.”

—Walter Schachermayer, Full Professor for Mathematical Finance, University of Vienna

“With their strong background in numerical simulation of industrial problems, the authors succeed to develop the concepts of different numerical schemes which are useful for computational finance and essential for valuation, risk analysis and the risk management of financial instruments. Especially in times of difficult market environments, the mathematical and algorithmic foundation of software used in banking must be a solid one which avoids additional traps of poor implementation. A Workout in Computational Finance gives clear recommendations for the preferred numerical methods for various models and instruments. The book will be utmost useful for practitioners but it also will be of great interest for researchers in the field.”

—Gerhard Larcher, Institute of Mathematical Finance, Kepler Universität

“The authors cover a broad range of numerical techniques for differential equations in computational finance, such as finite elements, trees, Monte Carlo, Fourier techniques and parameter calibration. Using sound, yet compact mathematical reasoning, they capture the substance of models for interest rate and equity derivatives, and provide hands-on guidance to numerics, covering all sorts of practical challenges. A vast number of numerical results illustrate potential implementation pitfalls and the mitigation techniques presented. With its strong focus on tangible usability this book is a highly valuable manual for students as well as professionals.”

—Robert Maringer, Head Valuation Control Switzerland, Credit Suisse

“For shaping your body you should go to a gym, while for building up your numerical toolkit you need a workout in computational finance. This modern treatment of numerical methods in quantitative finance addresses problems that professionals working in the field face on a daily basis. The very clear presentation of the material also makes it a perfect fit for students having a background in the theory of mathematical finance who want to gain insight on how practical problems are tackled in the industry.”

—Philipp Mayer, Financial Modeling, ING Financial Markets, Brussels